Overview of the Automotive PCB Market

The automotive PCB market encompasses the design, manufacturing, and supply of printed circuit boards (PCBs) specifically tailored for use in automotive applications. These PCBs are essential components in various automotive systems, including infotainment, advanced driver assistance systems (ADAS), powertrain control, and body electronics.

The market is driven by several factors, including:

- Increasing demand for electric vehicles and hybrid electric vehicles

- Growing adoption of advanced driver assistance systems (ADAS) and autonomous driving technologies

- Rising consumer expectations for advanced infotainment systems and connectivity features

- Stringent safety and emission regulations pushing for the development of more efficient and reliable electronic systems

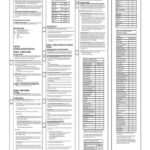

Market Size and Growth Projections

According to recent market research reports, the global automotive PCB market size was valued at USD 14.8 billion in 2020 and is projected to reach USD 22.3 billion by 2026, at a CAGR of 7.1% during the forecast period (2021-2026).

| Year | Market Size (USD Billion) | Growth Rate (CAGR) |

|---|---|---|

| 2020 | 14.8 | – |

| 2021 | 15.9 | 7.1% |

| 2022 | 17.0 | 7.1% |

| 2023 | 18.2 | 7.1% |

| 2024 | 19.5 | 7.1% |

| 2025 | 20.9 | 7.1% |

| 2026 | 22.3 | 7.1% |

The growth of the automotive PCB market is attributed to the increasing demand for advanced electronic systems in vehicles, the rising adoption of electric vehicles, and the growing trend towards autonomous driving.

Key Players and Market Shares

The automotive PCB market is highly competitive, with several key players vying for market share. Some of the prominent companies operating in this market include:

- Nippon Mektron

- Meiko Electronics

- KCE Electronics

- Unimicron

- Tripod Technology

- Young Poong Electronics

- CMK Corporation

- Daeduck Electronics

- Chin-Poon Industrial

- TTM Technologies

These companies have established themselves as leaders in the automotive PCB market through their expertise in PCB design, manufacturing capabilities, and strong partnerships with automotive OEMs and Tier 1 suppliers.

Market Share Distribution

The market share distribution among the key players in the automotive PCB market is as follows:

| Company | Market Share |

|---|---|

| Nippon Mektron | 18% |

| Meiko Electronics | 12% |

| KCE Electronics | 10% |

| Unimicron | 8% |

| Tripod Technology | 7% |

| Young Poong Electronics | 6% |

| CMK Corporation | 5% |

| Daeduck Electronics | 4% |

| Chin-Poon Industrial | 3% |

| TTM Technologies | 2% |

| Others | 25% |

The market share data indicates that Nippon Mektron holds the largest share in the automotive PCB market, followed by Meiko Electronics and KCE Electronics. However, the “Others” category, which includes numerous smaller players, collectively holds a significant 25% share of the market, highlighting the fragmented nature of the industry.

Growth Opportunities for PCB Designers

The automotive PCB market presents significant growth opportunities for PCB designers, as the demand for advanced electronic systems in vehicles continues to rise. Some of the key growth areas for PCB designers in the automotive industry include:

Electric Vehicle (EV) PCBs

The increasing adoption of electric vehicles is driving the demand for specialized PCBs that can handle high power requirements and ensure reliable performance. PCB designers with expertise in designing boards for EV applications, such as battery management systems, motor controllers, and charging systems, are well-positioned to capitalize on this growing market segment.

Advanced Driver Assistance Systems (ADAS) PCBs

ADAS technologies, such as adaptive cruise control, lane departure warning, and automatic emergency braking, rely heavily on sophisticated electronic systems. PCB designers who can develop compact, high-performance boards for ADAS applications will find significant opportunities in this rapidly growing market.

Infotainment and Connectivity PCBs

Modern vehicles are equipped with advanced infotainment systems and connectivity features, such as touchscreens, navigation systems, and wireless connectivity. PCB designers with experience in designing boards for these applications, which require high-speed data transfer and reliable performance, can tap into the growing demand for infotainment and connectivity PCBs.

Miniaturization and High-Density PCBs

As vehicles become more complex and space-constrained, there is a growing need for miniaturized and high-density PCBs that can fit into tight spaces while maintaining high performance. PCB designers who can create compact, multi-layer boards with fine pitch components will be in high demand in the automotive industry.

Challenges and Future Trends

While the automotive PCB market offers significant growth opportunities, it also presents several challenges that PCB designers and manufacturers must navigate:

-

Stringent quality and reliability requirements: Automotive PCBs must meet rigorous quality and reliability standards to ensure the safety and performance of vehicles in various operating conditions.

-

Cost pressure: The automotive industry is highly cost-sensitive, and PCB designers must find ways to optimize designs and manufacturing processes to reduce costs without compromising quality.

-

Supply chain disruptions: The global nature of the automotive industry makes it vulnerable to supply chain disruptions, such as the recent COVID-19 pandemic, which can impact the availability of raw materials and components.

Despite these challenges, the automotive PCB market is expected to continue its growth trajectory, driven by the increasing adoption of advanced technologies and the growing demand for electric and autonomous vehicles. Some of the future trends that will shape the market include:

-

Increased use of flexible and rigid-flex PCBs to accommodate complex packaging requirements and enable advanced features.

-

Adoption of advanced materials, such as high-temperature laminates and low-loss dielectrics, to meet the demanding performance requirements of automotive applications.

-

Integration of embedded components and 3D packaging technologies to further miniaturize PCBs and improve system integration.

-

Growing emphasis on sustainability and eco-friendly manufacturing processes to reduce the environmental impact of automotive PCB production.

Frequently Asked Questions (FAQ)

-

What is the current size of the automotive PCB market?

The global automotive PCB market size was valued at USD 14.8 billion in 2020. -

What is the projected growth rate of the automotive PCB market?

The automotive PCB market is projected to grow at a CAGR of 7.1% during the forecast period (2021-2026), reaching USD 22.3 billion by 2026. -

Who are the key players in the automotive PCB market?

Some of the key players in the automotive PCB market include Nippon Mektron, Meiko Electronics, KCE Electronics, Unimicron, Tripod Technology, Young Poong Electronics, CMK Corporation, Daeduck Electronics, Chin-Poon Industrial, and TTM Technologies. -

What are the main growth drivers for the automotive PCB market?

The main growth drivers for the automotive PCB market include the increasing demand for electric vehicles, the growing adoption of advanced driver assistance systems (ADAS) and autonomous driving technologies, rising consumer expectations for advanced infotainment systems and connectivity features, and stringent safety and emission regulations. -

What are the key challenges faced by the automotive PCB market?

The key challenges faced by the automotive PCB market include stringent quality and reliability requirements, cost pressure, and supply chain disruptions. PCB designers and manufacturers must navigate these challenges while meeting the demanding performance and functionality requirements of automotive applications.

In conclusion, the automotive PCB market is a dynamic and rapidly growing segment of the PCB industry, driven by the increasing adoption of advanced technologies in vehicles. With the rising demand for electric vehicles, ADAS, and infotainment systems, PCB designers have significant opportunities to innovate and create high-performance, reliable, and cost-effective solutions for the automotive industry. By staying abreast of the latest trends and technologies, PCB designers can position themselves to capitalize on the growth potential of this exciting market.

Leave a Reply